Looking For Legal Credit Repair?

These days, trying to your raise your credit score is not unusual. Many people have used and abused their credit to the point where the credit card companies and closing the books on them. When matters get to these proportions, looking for legal credit repair is not a bad choice. Following are a few excellent resources for professional legal repair to help your future credit response. It is advisable to do a little research into a company's background before you go headlong into a contract with them, Fortunately, most companies have available information on their past business experiences and success. One ...

Getting Out Of Debt

In the current financial climate, debt is a word that we hear almost every day and many are searching for best methods for getting out of debt. Living in a nation of credit based consumption, it really was only a matter of time before the debts came to a head. For some it crept slowly up on them and for others it was a short sharp slap in the face. Many who previously sailed along without debts or any financial worries for that matter are losing their jobs and being faced with the nightmare that is debt problems for the ...

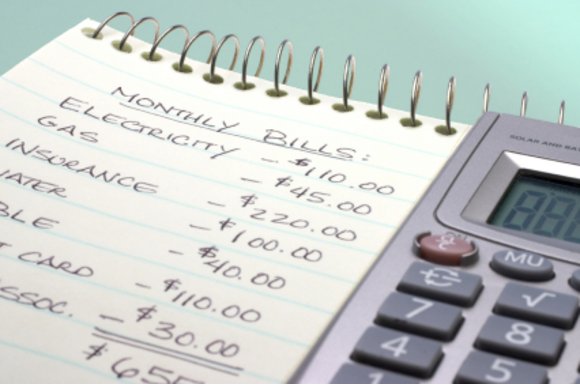

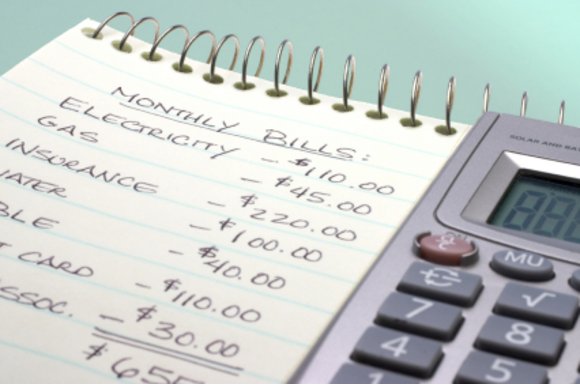

Cutting Costs to Avoid Home Foreclosure

Everyone comes upon hard times at some point in their life, but facing real estate foreclosure can seem especially stressful. No matter what event brought you to this state, it's important to take hold of the situation immediately and rein in your spending so you can attempt to stay current on your most important investment: your home. Of course, you should reassess your family's budget and spending habits way before you are ever late on a bill; many are quite surprised to learn that even in the midst of foreclosure proceedings, they are able to come up with the funds ...

What to Know When Buying Real Estate for the First Time

If you're looking at buying a property for a residence or investment and have never been through the process before, congratulations! Buying real estate is extremely exciting, but can also throw a few surprises your way if you're a novice. Here, we'll discuss some ways to minimize your risks and surprises and still profit from your real estate investment. First, you need to determine what market you're looking at. Perform an online search for available properties in your desired area to get an idea of housing prices there, and how much house you might be able to afford. ...

Personal Finance-Four Ways to Pay Off Debt

One problem that most people are having trouble facing is debt. People just owe so much money to their debtors and they do not know how to even repay it with all the expenses they have. Now, with the current financial crisis, the obligation is even harder to meet. But it is necessary that you sort out your personal finances before it’s too late. Below is a personal financial advice on the ways you can pay off your debt for a brighter financial future. Tip # 1 Pay More than the Required Minimum Amount of Repayment The best way to get rid ...

Personal Finance Basics–Getting Help Out of Your Financial Rut

Many average Americans are now finding out that when it comes to financial literacy, we have a lot to learn. Many people have worked day in and day out, earning sizeable incomes only to lose it in unwise investments and bad financial decisions. Personal financial management means taking control and responsibility of your own monetary decisions. Without the right information, mistakes are easily made. For example, many people often underestimate the accumulated interests and charges of loans and credit cards leading to ballooning debts. Personal finance books can help you take the first steps to ridding yourself of accumulated liabilities with ...

Personal Finance Software-Professional Help in Just a Few Clicks

Let’s face it, when it comes to making money decisions, we can all use some help. Many self-made millionaires attribute their success to incredible gut-feel about money or to luck, but chances are they had sound knowledge about budgeting, saving, and investing. Although using basic common sense is still the foundations for managing finances, financial management nowadays has become more complex. While millionaires and corporations enjoy the services of professional financial analysts to help them make financial decisions, average income earners will have to rely on less expensive sources of information. Fortunately, there are several personal finance software now available to ...

The Federal Family Education Loan Program

The Federal Family Education Loan Program (FFELP) is a governmental private lender partnership and umbrella student loan program that gives out federal student loans. This includes Stafford student loans, PLUS student loans, and Perkins student loans. The FFELP was established by an Act of Congress in 1965 and started in 1966. Ever since then, over half a trillion dollars have been given out as student loans, over $50 billion of which were given in 2006 alone. The funds used for Stafford student loans, PLUS student loans and other FFELP student loans come from a wide number of independent banks, credit unions ...

Student Loan Refinancing-Paying for Your College Education After College

Getting into a good college can be hard enough. Paying for a good college education can be harder; this is especially true for the financially challenged. A common way to go if you really want to pursue a college education but lack the monetary resources is to go for a student loan. This will enable you to pay college tuition at present and mind about it later. For some people, this arrangement works just fine. For some, it doesn't. Finishing college and having a degree can't guarantee financial stability, much more success since it doesn't work that way in the real ...

Small Business Finance Resources

If you wish to be a personal small business, but have absolutely no idea where you can get the small business finance resources that you need to being, then you should take several options under consideration to aid your current situation. Go to your local government agency to see if they have government small business loans on offer. Several government small business loans can be applied to on different levels (local, state, or federal) in order to receive business loans for you to begin with. You can even avail of micro loans or disaster relief loans to build up your business ...

Decrease the Sale Time Required for Your Property

Housing markets that are rising make selling a home quite easy profits are big, and buyers are everywhere, knocking on doors and scrambling to get in to the property of their dreams. However, housing goes through its own cycle as well, and may level off, creating multiple 'For Sale' signs to seem to be permanent fixtures in the area. There are some viable options for a seller who absolutely must sell during a down market for some reason. Many sellers actually think the sale of their property is pressing when it isn't. First, ensure you're concerned for ...

The 401k Retirement Plan-Plan A Bright Future

Nobody wants to retire only to be constantly worrying about paying the bills. This is a time in your life where you deserve to kick back and enjoy every minute you can. The 401K retirement plan is designed to take care of the money issues and let you relax. This article will help you understand how the 401K retirement plan works and how it can work to your advantage. The beauty of this type of retirement planning is that not only do you have a retirement fund, but you can increase you current income. This is because you do not have ...

Should You Refinance Your Mortgage?

Everyday, homeowners are bombarded with offers and advertisements to refinance their mortgage at a lower rate. There are times when home refinancing is a great idea, and others when it may not be. Reasons to pursue a mortgage refinance would include a lower interest rate, which may lead to lower monthly payments and the total amount of interest paid. Perhaps your credit score has greatly improved since you took out your first mortgage, or interest rates are considerably lower. You may also be considering financing improvements to your home and taking additional equity out of your home to pay ...

Group Health Insurance and How it Affects You and Your Future

We are all feeling the weight of the economic crisis and along with this condition basic commodities as well as medical costs right now have gone to an insurmountable amount. You would be lucky enough if you are still employed in your company because for sure you are covered under your group health insurance. What is alarming is that if your company shuts down you would be left with no work and no insurance at all. We all know how important it is to belong to a group health insurance. It is also one way of making sure that we can ...

Loans

Student Loans-What are Subsidized and Unsubsidized Student Loans?Getting a student loan may sometimes be just as hard as playing the stock market....

The William D Ford Direct Student Loan ProgramThe direct student loan program started around fifteen years ago and was designed...

The Federal Family Education Loan ProgramThe Federal Family Education Loan Program (FFELP) is a governmental private lender...

Read More Posts From This CategoryHome Finance

Mortgage Modification vs. Refinancing: Which Should You Choose?If you’re one of the millions of troubled homeowners suffering from increased...

Foreclosure Processes and RemediesWorrying about where your next mortgage payment is coming from can be extremely stressful...

Forbearance Agreements Can Stop Real Estate ForeclosureLosing a job or suffering from a major illness or injury can greatly reduce your...

Read More Posts From This CategoryPersonal Finance

Rake In the Cash With A Garage SaleEveryone love a sale. It is not just the bargain prices of a garage sale, but the...

Progress In Life And Make Your Hobby Your New JobIt is easy to settle with what you have. Maybe you are stuck in a nine to five job...

Upgrade Your Income With A Second JobWith the cost of living in general going skywards, most people are feeling the pinch....

Read More Posts From This CategoryInsurance

Business Insurance–The Different Policy Types Your Business DeservesBusiness insurance is a broad concept that can be subdivided into 9 types of policies....

Home Insurance–A Necessity to SafetySo you finally decided to get a new house for your family. The neighborhood is perfect...

Renters Insurance–Keeping your Apartment ProtectedSo, you’ve been living in an apartment. Renting an appartment could prove to be...

Read More Posts From This CategoryTrading

Value and Prices in Options TradingPart IIIf you have read Part I of this series, you will remember the example of a stock...

Value and Prices in Options TradingPart IPerhaps the biggest difference between trading stocks and options is the fact that...

Using ‘The Greeks’ in Options TradingPart IIIf you read Part I, you are slightly familiar with using the Greeks as indicators...

Read More Posts From This CategoryReal Estate Investing

What to Know When Buying Real Estate for the First TimeIf you’re looking at buying a property for a residence or investment and have...

Using the Internet to Buy and Sell Real EstateIn recent years, the vastness of the growing Internet businesses has come to affect...

Things You Should Know Before Investing In ForeclosuresIf you’ve never invested in a foreclosure home before, the advertised listings...

Read More Posts From This CategorySave Money

Tips to Save Money on GiftsNow is as great a time as ever to reign in your expenses and save money to pay off debt or simply build up your emergency savings account. However, holidays, birthdays and life events will still happen during tough economic times, and it’s essential to learn how to save money on the many gifts you find yourself shopping for this year. Preparing... [Read more of this review]

Saving Money on Your Monthly Electric BillMonthly expenses compose the largest part of our budgets, especially those for utility services. We can always count on these bills arriving very timely every month, and having to pay them within a few days or weeks to avoid paying late fees. Your electric bill can easily be lowered enough to save you 20 to 30 percent on your monthly and annual fees... [Read more of this review]

Money Saving Ideas for Your TV, Phone and Internet BillsMonthly expenses are the total or excess of our budget, and one of the easiest and painless ways to save money is finding ways to lower your monthly bills you know you’ll receive. In order to save money quickly in an emergency situation, you may need to eliminate your entertainment services and read a book or two temporarily. However, you should... [Read more of this review]

Read More Posts From This Category